Panduan Lengkap Bermain Mobile Legends: Bang Bang untuk Pemula dan Pro!

Mobile Legends: Bang Bang adalah salah satu game mobile yang sangat populer di seluruh dunia. Game ini menawarkan pengalaman bermain yang seru dan kompetitif, di mana pemain dapat berkolaborasi dalam sebuah tim untuk mengalahkan lawan. Dengan berbagai karakter yang memiliki kemampuan unik, setiap pertandingan menjadi menarik dan penuh strategi. Bagi pemula, memahami dasar-dasar permainan ini sangat penting untuk bisa bersaing dengan pemain lain, sementara bagi pemain pro, terus mengasah kemampuan dan strategi adalah kunci untuk meraih kemenangan.

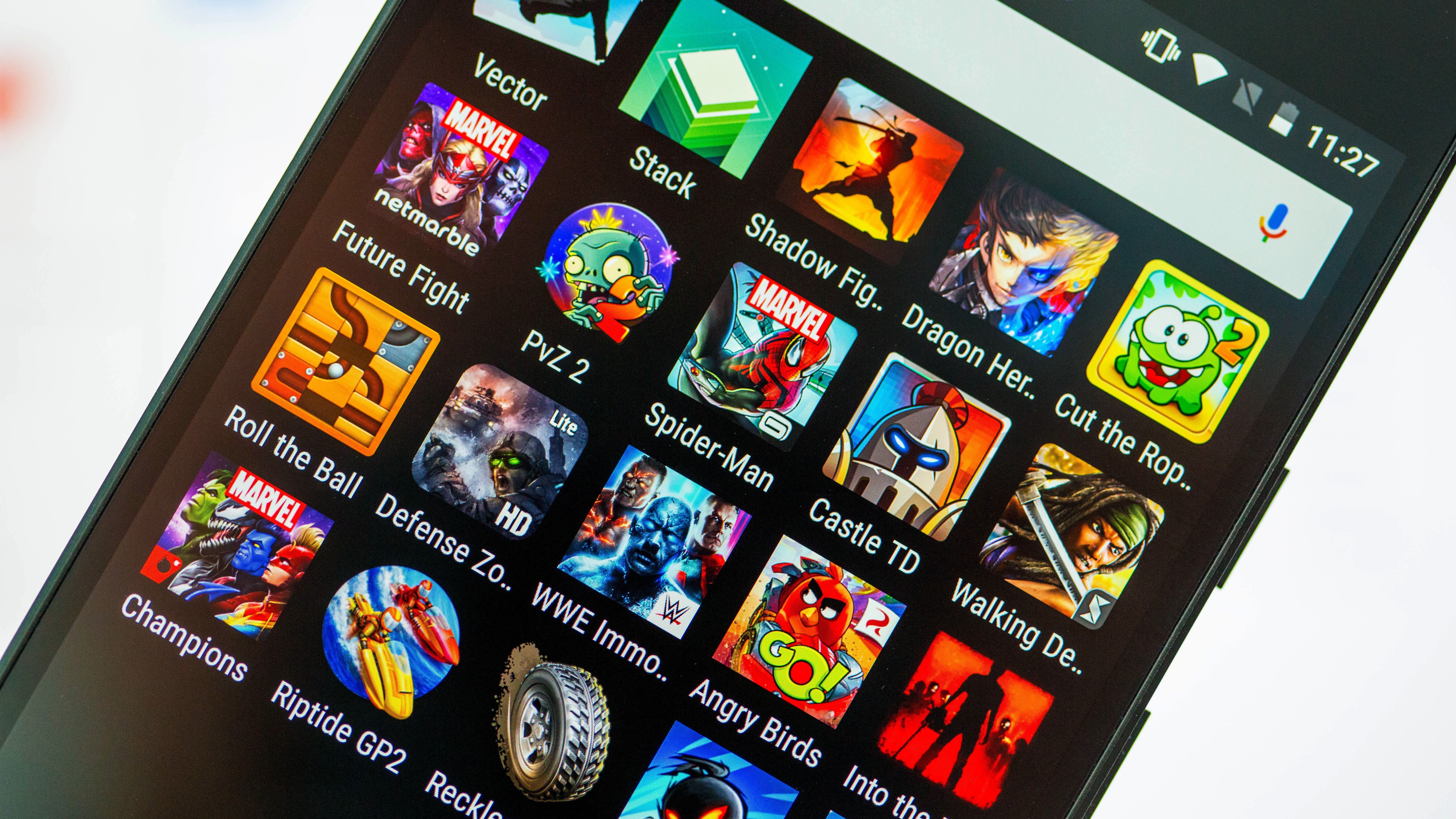

Banyak yang bertanya-tanya, apakah bisa bermain Mobile Legends: Bang Bang di Android dan iOS? Jawabannya tentu saja bisa. Game ini dirancang untuk bisa dimainkan di berbagai platform, sehingga Anda bisa bergabung dalam pertempuran seru ini baik melalui smartphone Android maupun iPhone. Dengan kemudahan akses ini, semakin banyak pemain yang bisa merasakan keseruan dan tantangan yang ditawarkan oleh Mobile Legends: Bang Bang. Dalam panduan ini, kita akan membahas cara bermain serta tips untuk pemula dan pro agar bisa meningkatkan skill dalam bermain game yang satu ini.

Apa Itu Mobile Legends: Bang Bang?

Mobile Legends: Bang Bang adalah sebuah permainan online yang sangat populer di kalangan penggemar game mobile. Game ini merupakan genre MOBA (Multiplayer Online Battle Arena) yang memungkinkan pemain untuk bertarung dalam tim 5 vs 5. Dalam permainan ini, pemain akan memilih hero yang memiliki kemampuan unik, berusaha menghancurkan base lawan sambil mempertahankan basis sendiri.

Setiap pertandingan biasanya berlangsung selama 10 hingga 15 menit, di mana pemain harus bekerja sama dengan rekan tim untuk meraih kemenangan. Mobile Legends menawarkan berbagai mode permainan, termasuk Classic, Ranked, dan Brawl, yang memberikan pengalaman berbeda tergantung pada preferensi setiap pemain. Selain itu, perkembangan permainan dilakukan dengan menambah hero baru, skin, dan variasi gameplay yang menarik.

Mobile Legends: Bang Bang dapat diakses oleh siapa saja yang memiliki perangkat mobile. Ini menjadi salah satu alasan mengapa game ini sangat diminati. Pemain dapat bergabung dengan komunitas global yang aktif dan bersaing dengan pemain dari seluruh dunia. Dengan kontrol yang sederhana dan gameplay yang cepat, Mobile Legends: Bang Bang cocok untuk pemula maupun pemain yang lebih berpengalaman.

Bermain Mobile Legends: Bang Bang di Android

Mobile Legends: Bang Bang adalah salah satu game MOBA yang paling populer di platform Android. Untuk memulai permainan, Anda perlu mengunduh aplikasi dari Google Play Store. Pastikan perangkat Anda memenuhi spesifikasi minimum yang diperlukan agar permainan berjalan dengan lancar. Setelah mengunduh, lakukan registrasi atau masuk menggunakan akun yang sudah ada untuk mulai bermain.

Ketika bermain Mobile Legends di Android, kontrol permainan sangat mudah diakses. Anda akan menggunakan joystick virtual di sisi kiri layar untuk bergerak, sementara tombol skill dan serangan berada di sisi kanan. Ini memungkinkan pemain untuk mengendalikan karakter dengan cepat dan efektif, terutama saat melakukan tim fight atau menghindari serangan musuh. Pastikan untuk selalu berlatih mengatur posisi dan penggunaan skill secara tepat.

Untuk pengalaman bermain yang optimal, pastikan koneksi internet Anda stabil. Lag atau koneksi yang buruk dapat sangat mempengaruhi performa Anda di dalam permainan. Selain itu, Anda juga bisa menyesuaikan pengaturan grafis dalam permainan sesuai dengan kemampuan perangkat Anda. Dengan semua ini, Anda bisa menikmati pertandingan yang menarik dan bersaing dengan pemain lainnya di Mobile Legends: Bang Bang.

Bermain Mobile Legends: Bang Bang di iOS

Mobile Legends: Bang Bang adalah game yang sangat populer di kalangan pengguna iOS. Game ini dapat diunduh melalui App Store dengan mudah. Pastikan perangkat Anda memenuhi syarat minimum untuk menjalankan game ini dengan lancar, seperti memiliki cukup ruang penyimpanan dan versi iOS yang kompatibel. Setelah mengunduh, Anda dapat langsung memulai petualangan dan berkompetisi dengan pemain lain dari seluruh dunia.

Setelah berhasil menginstal Mobile Legends di perangkat iOS Anda, langkah selanjutnya adalah membuat akun. Anda dapat menggunakan akun Facebook, Moonton, atau metode pendaftaran lainnya yang tersedia. Setelah mendaftar, Anda akan dibawa ke antarmuka utama di mana Anda bisa mulai bermain. Pelajari fitur-fitur yang ada dan jangan ragu untuk mencoba mode latihan untuk memahami mekanisme permainan sebelum terjun ke pertandingan sesungguhnya.

Bermain di iOS juga menawarkan keuntungan dari segi grafis dan kontrol. Touchscreen yang responsif membuat pengalaman bermain menjadi lebih menyenangkan. Selain itu, pengaturan kontrol dapat disesuaikan sesuai dengan preferensi Anda untuk meningkatkan kenyamanan selama bermain. Jadi, siapkan tim Anda dan bersiaplah untuk melakukan strategi yang hebat dalam Mobile Legends: Bang Bang di perangkat iOS Anda.

:format(webp)/cdn0.vox-cdn.com/uploads/chorus_asset/file/7698905/Screen_Shot_2016_12_24_at_11.59.05_AM.png)